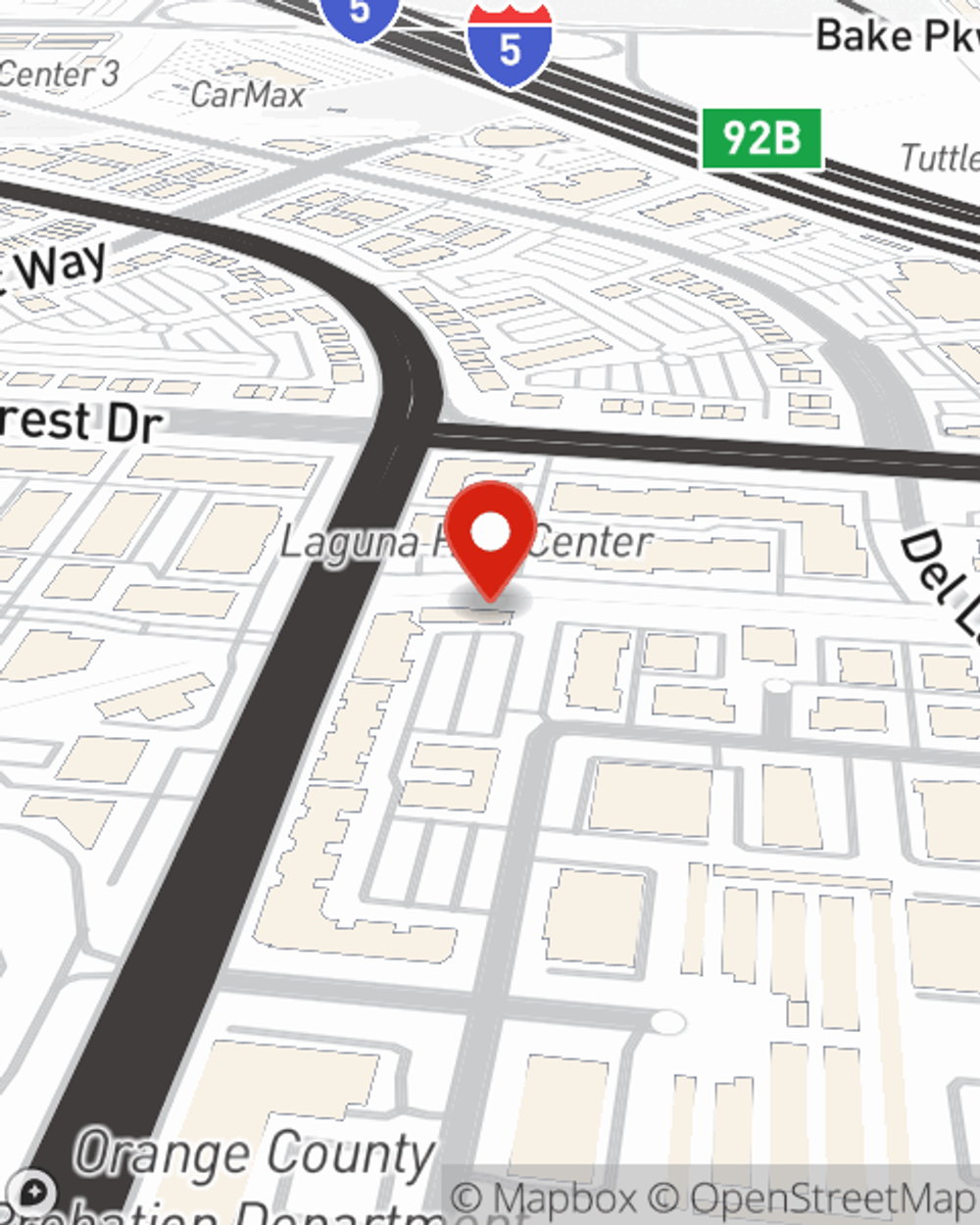

Condo Insurance in and around Laguna Hills

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Condo Sweet Condo Starts With State Farm

Things do happen.. Whether damage from lightning, vandalism, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unpredictable circumstances.

Here's why you need condo unitowners insurance

Insure your condo with State Farm today

Agent Adrian Garrick, At Your Service

You can rest assured with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with fantastic coverage that's right for you. State Farm agent Adrian Garrick can help you explore all the options, from replacement costs, possible discounts to a Personal Price Plan®.

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Contact agent Adrian Garrick today for more information.

Have More Questions About Condo Unitowners Insurance?

Call Adrian at (714) 540-5899 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Adrian Garrick

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.